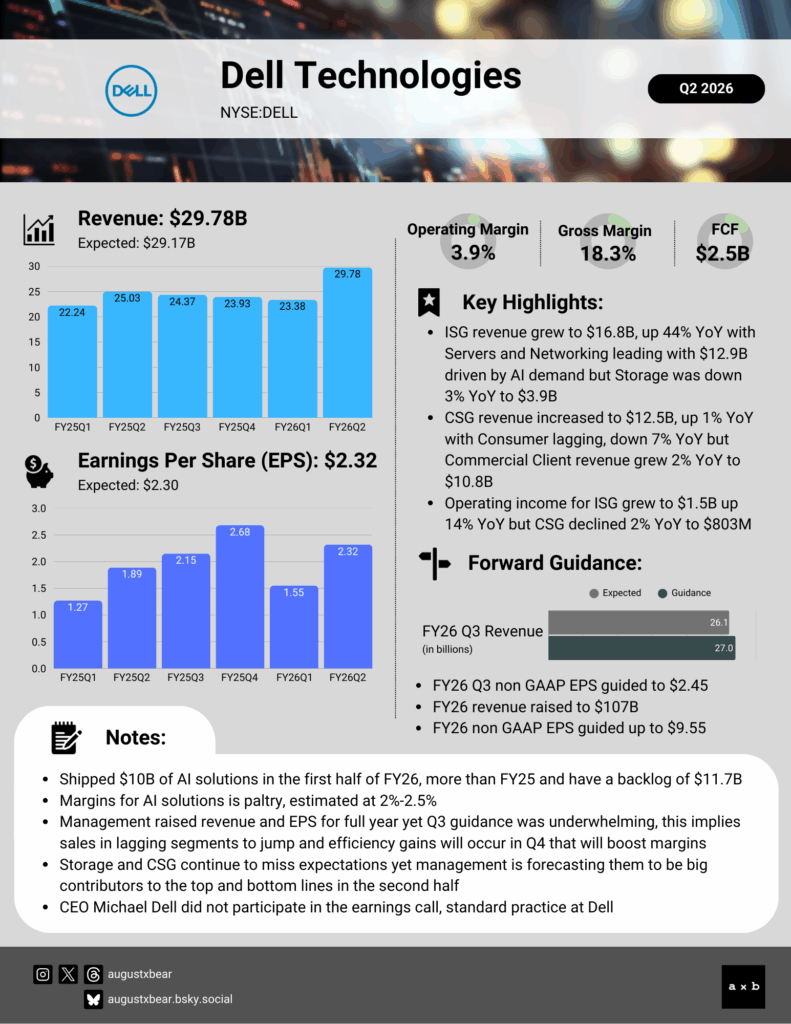

Dell Technologies (NYSE:DELL) reported mixed FY26 Q2 results, with revenue of $29.78 billion and EPS of $2.32 narrowly ahead of expectations. Demand for AI servers supported topline growth, but margins continued to contract. Gross margin slipped to 18%, and management did not challenge analyst estimates that AI solution margins are only 2–2.5%.

PC and storage sales once again fell short, with management repeating that refresh cycles should improve in later quarters. This has become a recurring message with little evidence of accuracy. The issue was compounded by Michael Dell’s continued absence from the earnings call, which undermines investor confidence. Management raised full-year guidance to $105–109 billion in revenue and $9.55 in EPS, but given Q3 guidance and Dell’s track record of overly optimistic forecasting, the outlook offers little reassurance.

Despite its position as a key supplier in the AI buildout, Dell is not capturing the full benefits of the boom. Growth is concentrated in low-margin hardware that pressures profitability. Stronger cash generation has helped liquidity, but Dell has not used this advantage to reduce its substantial debt load, leaving balance sheet concerns in place.

For more details, key highlights, and commentary, check out the high-level earnings summary.