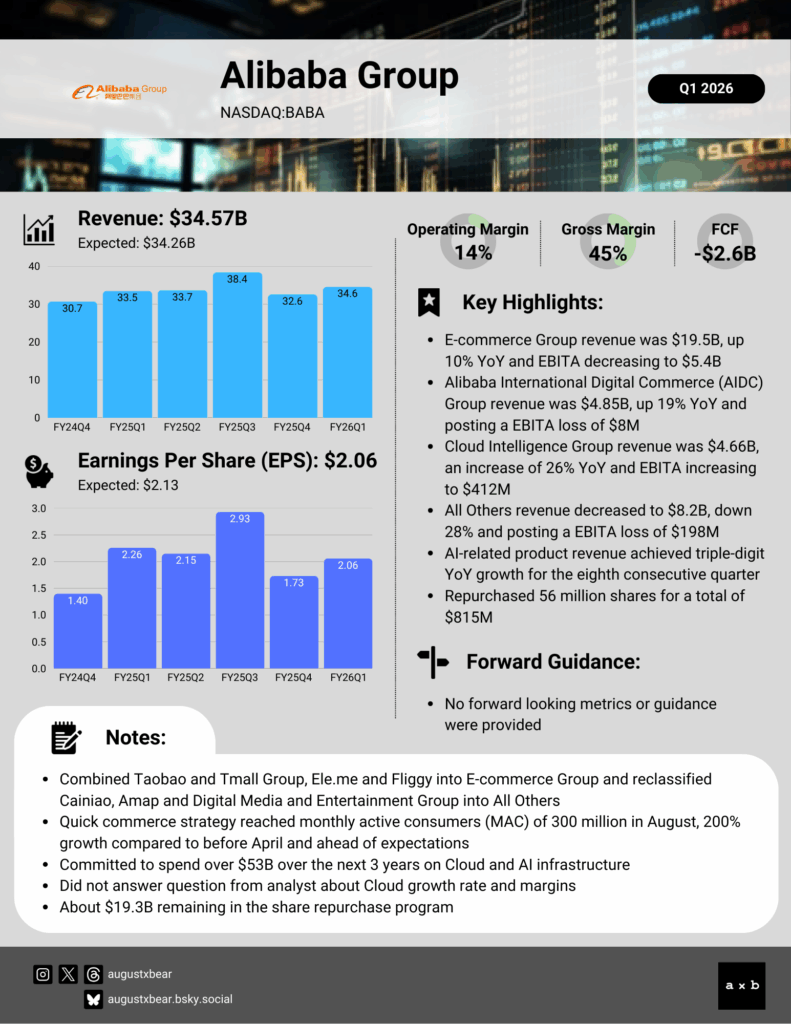

Alibaba Group (NASDAQ:BABA) reported mixed FY26 Q1 results, with revenue coming in above expectations but earnings falling short. Growth was broad-based across major segments. Margins improved in Alibaba International Digital Commerce (AIDC) and Cloud Intelligence Group, but contracted in the newly formed E-commerce Group due to a deliberate push into building out quick commerce infrastructure, not weakening demand.

The company continues to invest heavily in its initiatives across business segments, driving free cash flow outflows. Management reaffirmed plans to spend $53 billion over the next three years to expand AI infrastructure. Early momentum suggests these investments are gaining traction: Cloud Intelligence Group revenue rose 26% year-over-year in Q1, quick commerce activity and merchant participation increased under the E-commerce Group, and AI-related product revenue once again delivered triple-digit growth.

For more details, key highlights, and commentary, check out the high-level earnings summary.