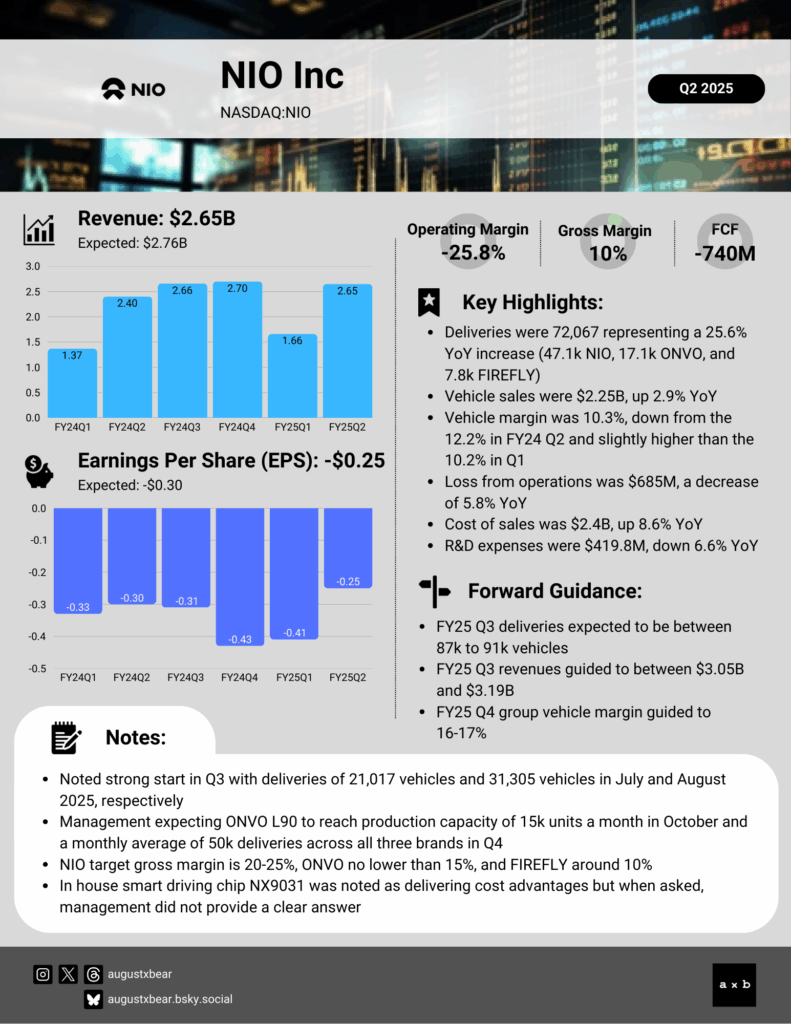

NIO Inc (NASDAQ:NIO) posted a mixed FY25 Q2, missing revenue expectations but surpassing earnings estimates as losses came in smaller than feared. Still, losses were significant with a $685 million operating loss and $740 million in free cash outflow for the quarter. Deliveries were encouraging, though the mix leaned toward lower-margin models. Early demand for both ONVO and new NIO vehicles has exceeded expectations, which management believes can support an average of 50,000 deliveries across all brands in Q4.

The optimism, however, is not new. Last November, management projected ONVO would reach 20,000 monthly deliveries by March 2025, but the figure came in below 5,000. Persistent inefficiencies continue to weigh on the company, with no clear path to breakeven or sustainable margin expansion. Research and development spending, cost of sales, and operating expenses remain elevated, while meaningful manufacturing or supply chain efficiencies have yet to emerge. NIO has strong products but struggles to make them marketable at scale. With its cash position steadily eroding, time is working against them.

For more details, key highlights, and commentary, check out the high-level earnings summary.