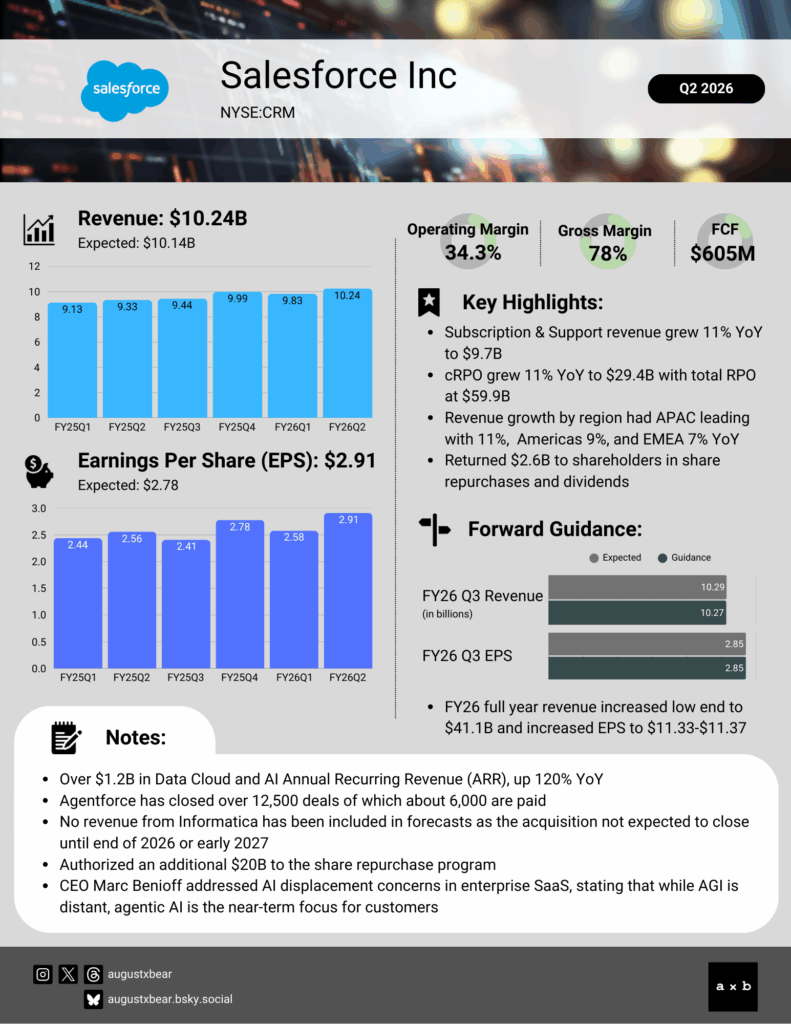

Salesforce Inc (NYSE:CRM) delivered solid FY26 Q2 results, exceeding expectations with $10.24 billion in revenue and $2.91 in EPS. Subscription revenue grew at a modest pace, with strength across geographies, and APAC once again led in percentage growth. Agentforce adoption continued to expand, with paid deals steady at about 50 percent.

Guidance for Q3 was mostly in line or slightly below expectations, while the full-year outlook was mixed. Management raised revenue and non-GAAP EPS estimates slightly, but lowered GAAP EPS. No explanation was provided for the GAAP revision, though management reiterated that free cash will continue to be directed toward buybacks, dividends, and acquisitions. It was also clarified that Informatica contributions will not be included in revenue forecasts until the acquisition closes, which could occur in late 2026 or early 2027.

CEO Marc Benioff struck an optimistic tone, highlighting Salesforce’s integration of AI across its products. However, results still reflect steady but modest growth, offering limited near-term catalysts for investors. There are ongoing concerns that AI could eventually disrupt enterprise SaaS, but the threat is distant since true AGI, or Artificial General Intelligence, remains many years if not decades away, a sentiment Benioff also reinforced during the call.

For more details, key highlights, and commentary, check out the high-level earnings summary.