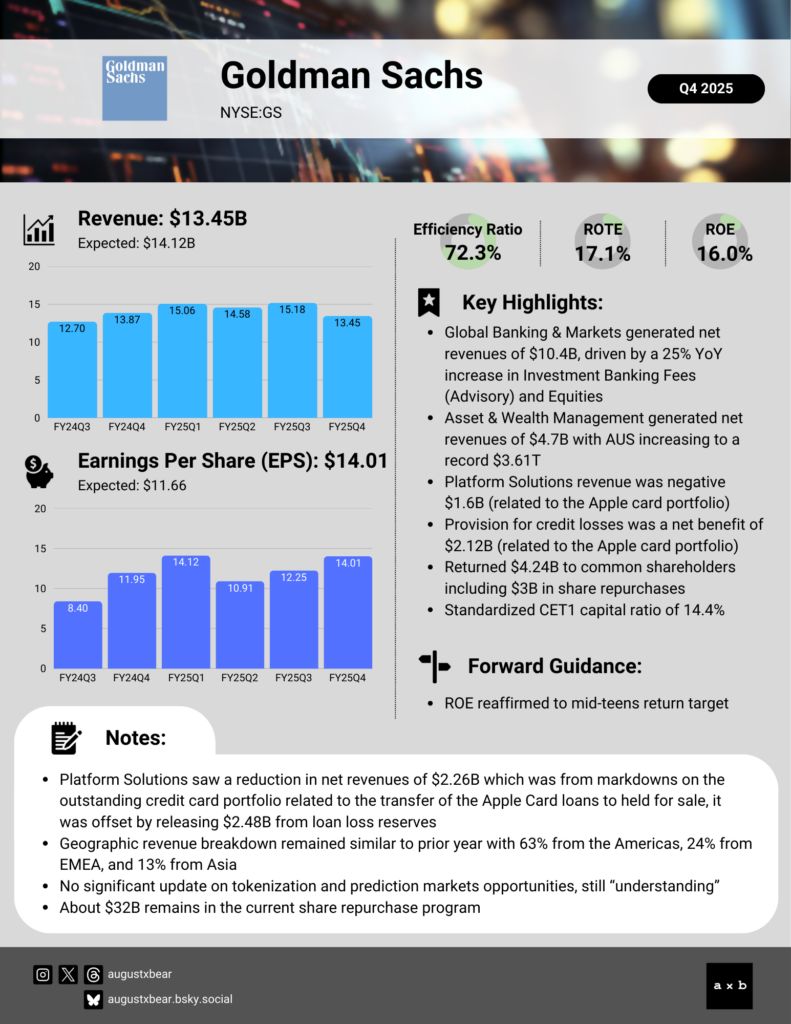

Goldman Sachs (NYSE:GS) reported mixed Q4 results, missing on revenue but exceeding EPS estimates. The quarter’s revenue took a $2.26 billion hit from markdowns on the Apple Card loan portfolio shifted to held-for-sale amid its transition to another issuer, offset by a $2.48 billion release in loan-loss reserves for a net $0.46 per share EPS boost.

Key financial metrics remained solid, with healthy return on equity (ROE), return on tangible equity (ROTE), efficiency ratio, and a strong common equity tier one (CET1) capital ratio. Investment banking trends were constructive, with mergers and acquisitions activity holding up well and management expressing a positive outlook supported by a more favorable policy environment, which should be supportive of margins.

For more details, key highlights, and commentary, check out the high-level earnings summary.