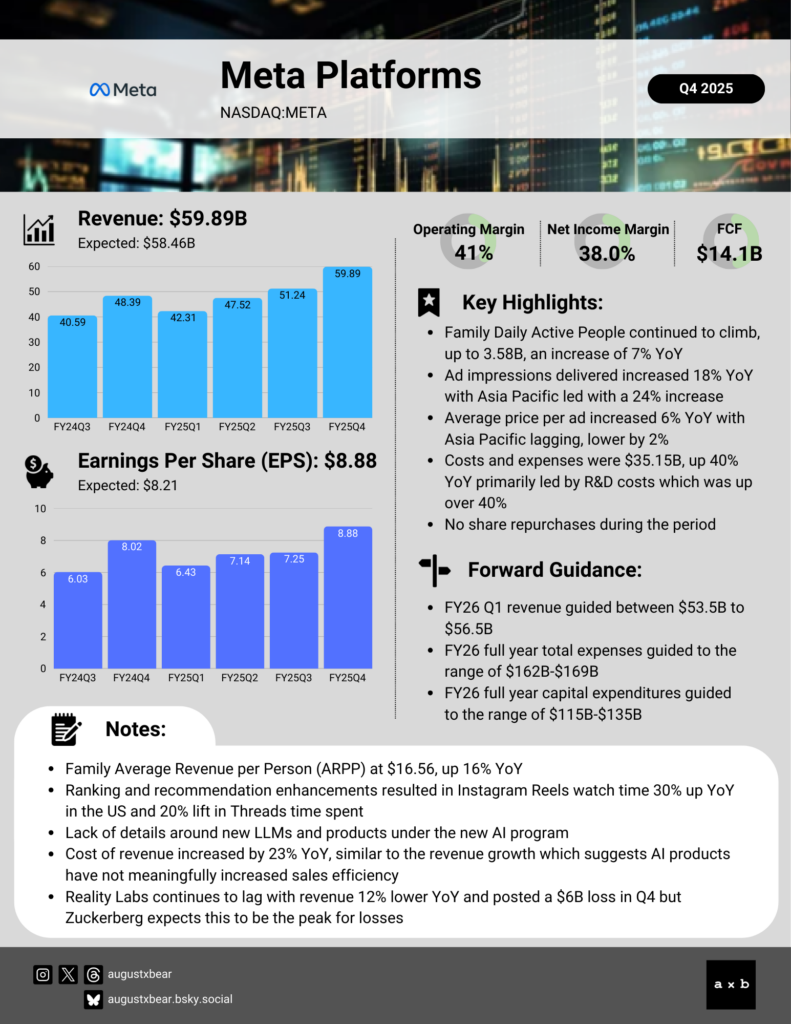

Meta Platforms (NASDAQ:META) closed out 2025 with a strong Q4, beating revenue expectations by more than 2% and EPS by 8%. User growth continues with Family Daily Active People now reaching 3.58 billion across its platforms. While the Asia Pacific region leads in growth rate, a shifting regional mix contributed to a slight drag on pricing.

Meta continues its heavy spend on AI efforts and plans to reveal initial results of its Meta Superintelligence Labs (MSL) in the coming months with new LLMs and products. While specific product details were limited on the call, the company signaled a massive infrastructure ramp-up, with 2026 capital expenditures expected to reach between $115 billion and $135 billion. Despite this aggressive spending, Meta shared guidance that beat expectations for Q1, forecasting revenue between $53.5 billion and $56.5 billion versus the consensus of $51.37 billion. It is important to note that this revenue guidance includes an expected 4% tailwind due to favorable exchange rates.

Reality Labs continues to face financial headwinds, losing $6 billion in the past quarter alone and bringing total 2025 divisional losses to over $19 billion. CEO Mark Zuckerberg noted that the strategic focus is shifting toward wearables like the Meta Ray-Ban glasses, which have seen strong consumer reception. Management also indicated that Reality Labs losses may have peaked, with 2026 losses projected to be similar to 2025 levels before gradually declining.

For more details, key highlights, and commentary, check out the high-level earnings summary.