PayPal Holdings (NASDAQ:PYPL) reported underwhelming Q4 results, missing consensus estimates on both revenue and earnings while issuing a weak outlook for 2026. Total revenue grew just 4% year-over-year, as the company continues to struggle with anemic growth metrics and fierce competition from Apple Pay and Google Pay. Most concerning was the performance of the core branded checkout business, which saw volume growth stall at a mere 1% currency-neutral. Management acknowledged that execution has not been where it needs to be and more investment dollars are needed to shore up the businesses.

The quarter was further complicated by the announcement of a sudden leadership change. Enrique Lores, the former CEO of HP Inc is set to take the helm as President and CEO in March, replacing Alex Chriss. While Lores has served on the board for several years, his appointment has raised eyebrows among some investors due to his background as a “hardware guy” with limited deep-domain experience in the rapidly evolving payments and fintech landscape.

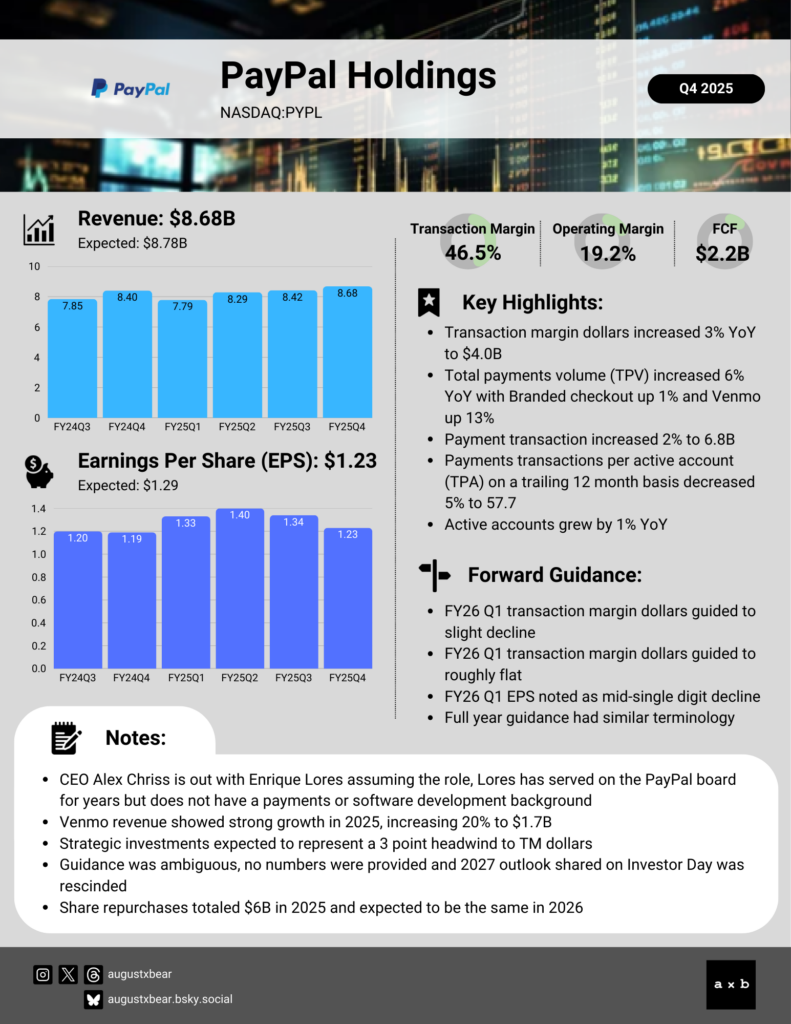

For more details, key highlights, and commentary, check out the high-level earnings summary.