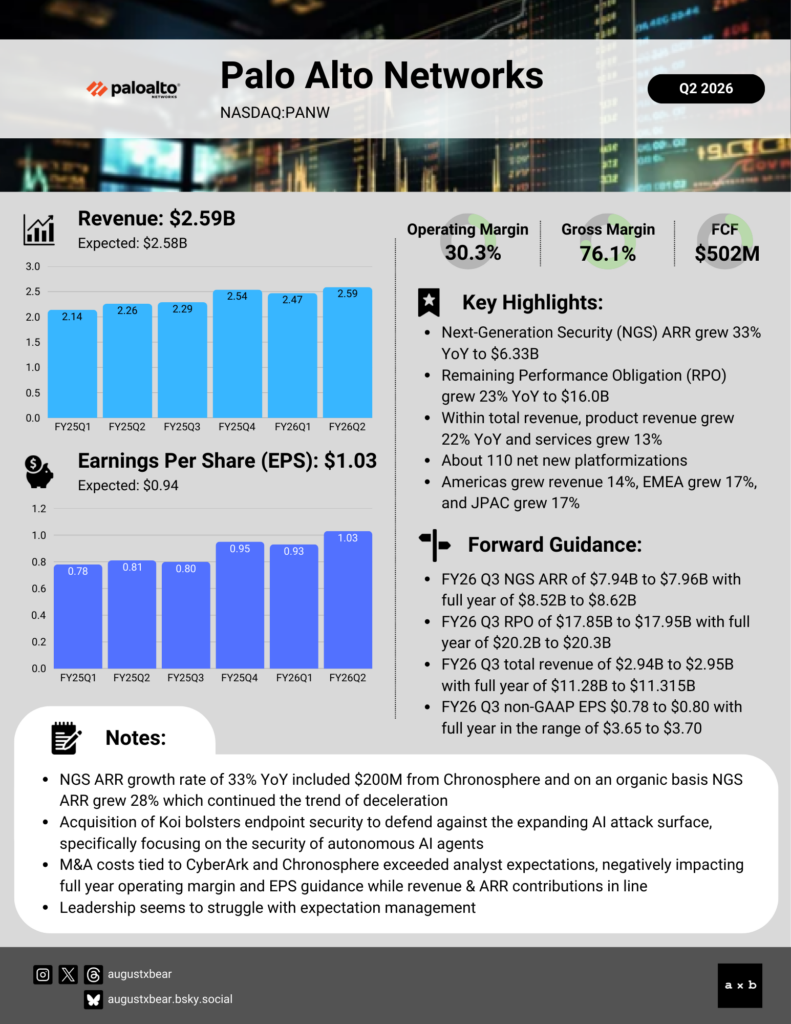

Palo Alto Networks (NASDAQ:PANW) delivered a complex Q2 FY26, as record operational performance was offset by a sharp downward revision in profit guidance. While the company beat top-line expectations with $2.59 billion in revenue (up 15% year over year) and maintained a record 30.3% non-GAAP operating margin, management significantly lowered its full-year non-GAAP EPS guidance to $3.65–$3.70, falling well below the previous analyst consensus of $3.86.

The primary driver for this revision was the unexpectedly high cost of integrating the $25 billion CyberArk and $3.35 billion Chronosphere acquisitions. Management cited substantial integration expenses and financing costs as they absorb these large-scale additions. This “beat and lower” scenario points to a struggle with expectation management, as the leadership team failed to adequately telegraph the financial drag of their aggressive M&A strategy. This concern is further amplified by the announcement of yet another acquisition, the $400 million purchase of Koi Security.

There appears to be a recurring mismatch between management’s narrative and market expectations under CEO Nikesh Arora. His public comments questioning why the market does not fully grasp his vision and results indicate a growing communication gap.

For more details, key highlights, and commentary, check out the high-level earnings summary.